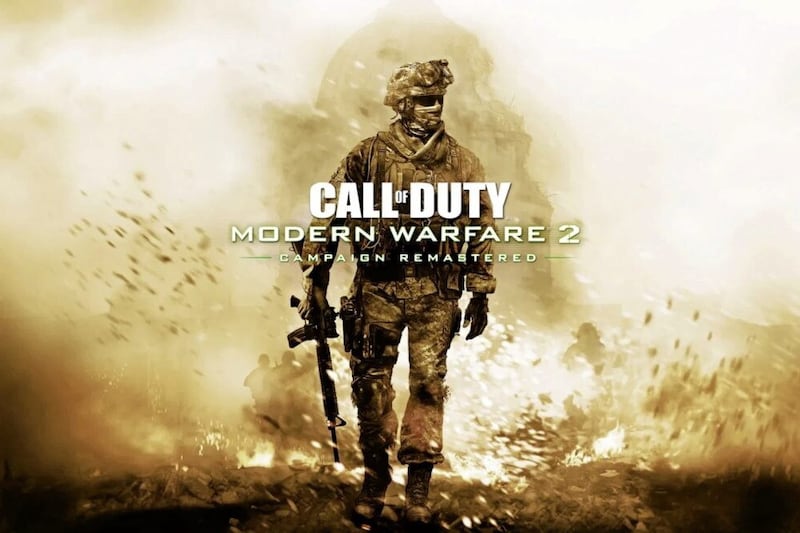

AS tens of thousands of gamers across the north settle into a wet weekend of indoor action on the likes of Call of Duty, World of Warcraft and Candy Crush, a resolution to the biggest technology merger in history may be edging closer.

Microsoft has offered $95 per share - a total of $69 billion (£54 billion) - to buy video game developer and Candy Crush owner Activision Blizzard and give it vital entry into the mobile gaming market.

Merging the two companies would give Microsoft, which owns the Xbox gaming console, complete control over popular video game franchises like Call of Duty, World of Warcraft and Overwatch.

But regulators say the merger comes at a time when concentration among technology companies is already threatening the competitive balance of the economy and in some cases even political systems.

They've taken issue mainly because they fear if Microsoft it would become too dominant in the gaming market and this could ultimately limit choice for consumers.

The UK competition watchdog the Competition and Markets Authority (CMA) has said it will decide whether to clear or block Microsoft’s takeover by August 29.

In April the CMA indicated that it would block the deal and is seeking public contributions on whether it should clear it after a new submission from Microsoft.

Instead of offering further concessions, Microsoft is arguing that the EU’s decision in May to clear the deal, as well as a recent games licensing deal with arch-rival Sony, represents a fundamental change to the circumstances around the transaction and there are now “special reasons” for not blocking it.

In its submission Microsoft said: “We consider that it is clear that there are material changes in circumstance and special reasons under the Enterprise Act which mean that the CMA should not adopt the draft order prohibiting the merger”.

The Enterprise Act contains a provision that allows the CMA to alter its final order – which in this case was heading towards a block – if there has been a “material change in circumstances” since it reached its published decision.

The CMA decided to hold a consultation on Microsoft’s new argument after guidance from the Competition Appeal Tribunal, an official body that hears appeals on the watchdog’s decisions.

A CMA spokesman said: “Microsoft has submitted a document detailing why it believes there are material changes of circumstance and/or special reasons why the CMA should not impose a final order to prohibit the merger.

“Submissions of this nature are possible but are very rare. We will consider Microsoft’s submissions carefully, along with other responses from interested parties, ahead of the August 29 statutory deadline.”

The CMA’s core objection to Microsoft’s takeover of a leading video game publisher has been that it would affect competition in the market for cloud gaming, which allows users to stream games stored on remote servers on to their devices.

But Microsoft said it had already improved competition in the cloud gaming market by striking agreements with the cloud gaming services NVidia, Boosteroid and Ubitus, allowing them to license Activision games for a decade after the deal is completed.

Microsoft also said any breach of its commitments would mean European approval would no longer be valid and put it at risk of fines of up to 10 per cent of its worldwide turnover, which would amount to $19.8bn if based on its 2022 turnover.

Its deal with Sony to keep Call of Duty on its rival PlayStation console for a decade was also significant in terms of the impact of the Activision deal and “addresses the primary concern of the most outspoken opponent of the merger”, Microsoft said.

The CMA’s US equivalent, the Federal Trade Commission, is also seeking to block the deal but failed recently in a bid to secure an injunction against the transaction.